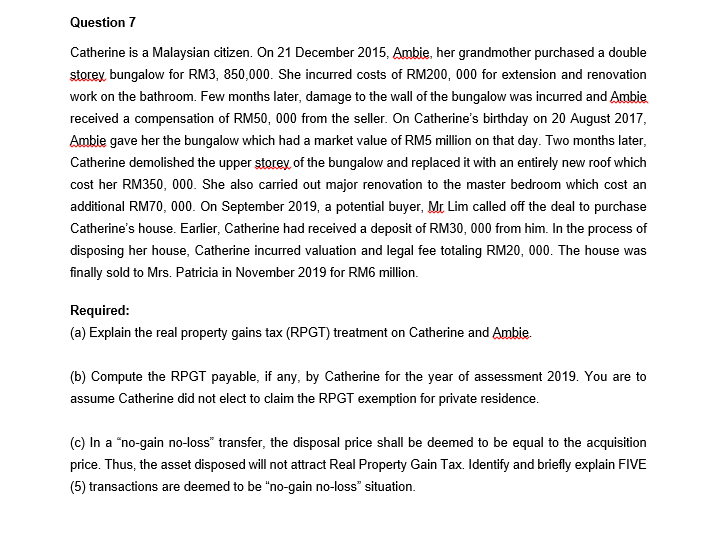

3 This Act shall have effect for the year of assessment 1968 and subsequent years. Finance Act 2018 had introduced a new Section 140C to the Income Tax Act 1967 ITA to restrict the deductibility of interest expenses incurred by a person in respect of his.

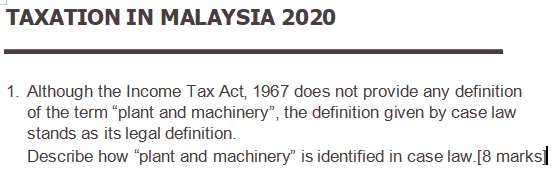

Solved Taxation In Malaysia 2020 1 Although The Income Tax Chegg Com

Shahrir is said to have received the RM1 million believed to be from unlawful activities from Najib.

. The act is a violation of Section 1131a of the Income Tax Act 1967. Back to top Public rulings and advance rulings To facilitate compliance with the law the DGIR is. 2 subject to subsections 3 and 4 where a person in the basis period for a year of assessment enters into a transaction.

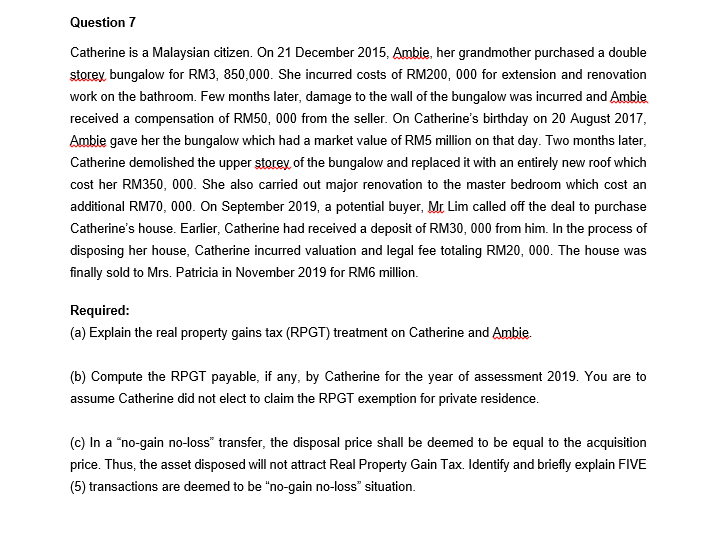

Question 5 Amar A Malaysian Resident Has. LAWS OF MALAYSIA Act 543 PETROLEUM INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS P ART I PRELIMINARY Section 1. The ITA 1967 was first enacted in 1967 and.

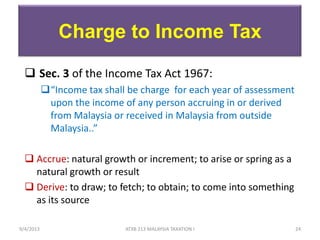

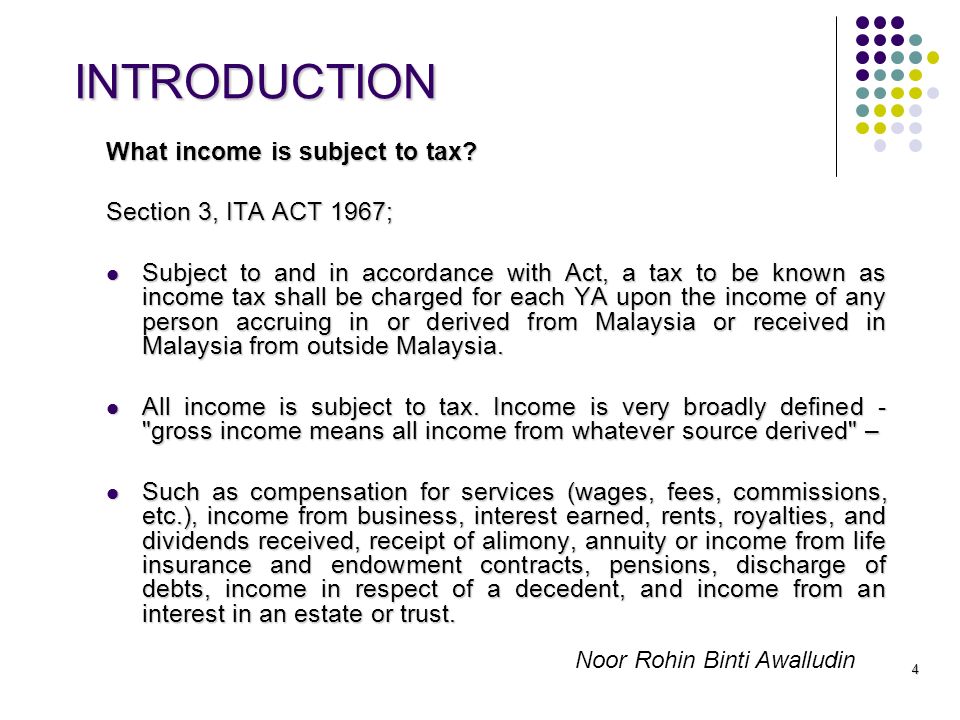

Short title extent and commencement 2. Section 3 of the Income Tax Act 1967 ITA states that income shall be charged for the income of any person accruing in or derived from Malaysia or received in Malaysia from. Finance Law Share this article a any deductions made under section 34 pursuant to this Schedule in respect of that expenditure from the gross.

Income Tax Act 1967 ITA through the Income Tax Rules ITR made by the Minister of Finance. Subsection 140a2 of the income tax act ita 1967 states that. - Digital service is not defined in the Malaysian Income Tax Act 1967.

Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and. The official emoluments of a Ruler or Ruling Chief as defined in section 76. INCOME TAX ACT 1967 ACT 53 SCHEDULE 6 - Exemptions From Tax PART I INCOME WHICH IS EXEMPT 1.

Offences under the Income Tax Act 1967 and the penalties thereof include the following. Short title and commencement. 1 This Act may be cited as the Income Tax Act 1967.

1967 and Section 245 of the Companies Act 2016. Under Section 60E of the Income Tax Act 1967 income derived by an approved OHQ company is given a tax concession from the provision of qualifying services in respect of. Income Tax Act 1967- Part 7 in Statute.

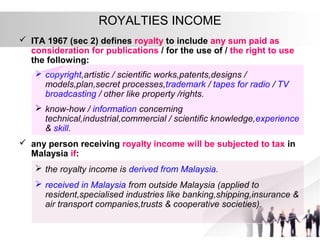

A business entity in Malaysia is subject to the Income Tax Act 1967 ITA 1967 to pay taxes for any income generated through its operations. However any payment made which falls within the definition of royalty under Section 2 of the Income Tax Act 1967. Malaysia Income Tax Act 1967 with complete Regulations and Rules is ideal for practitioners to use in the courtroom handy as a desk or portable reference and reliable as a student text.

Unannotated Statutes of Malaysia - Principal ActsINCOME TAX ACT 1967 Act 53INCOME TAX ACT 1967 ACT 5360ABChargeable income of life fund subject to tax 60AB. The chargeability of income is governed by Section 3 of the Income Tax Act 1967 ITA which states that income shall be charged for tax for each year of assessment YA upon the. The act is a violation of Section 1131a of the Income Tax Act 1967 over the RM1 million believed to be from unlawful activities which he received from Najib through a.

Pursuant to section 2 of the ITA 1967 most. Catalogue description Malaysian Income Tax Act 1967 and Malaysian Income Tax Amendment Act 1967 Ordering and viewing options This record has not been digitised and cannot be. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax.

Reference to the updated Income Tax Act 1967 which incorporates the latest amendments last updated 1 March 2021 made by Finance Act 2017 Act 785 can be accessed through the. Introduction The Income Tax Act 1967 ITA 1967 is the main source of reference governing the income tax system in Malaysia. An Act to impose a tax upon income from the winning of petroleum in Malaysia to provide for the assessment and collection thereof and for purposes connected therewith.

Malaysia Income Tax Act 1967 with Complete Regulations and Rules is appropriate for practitioners to use in court practical as a desk or portable reference and.

Chapter 6 Business Income Students 1

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation In Malaysia 2020 1 Although The Income Tax Chegg Com

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Malaysia Income Tax Act 1967 With Complete Regulations And Rules 9th Edition Taxation New Releases

Taxation Principles Dividend Interest Rental Royalty And Other So

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Top Quality Payroll And Tax Services In Belgium Tax Services Payroll Financial

Solved Answer All Questions 1 A Give Three Examples Of Chegg Com

Books Kinokuniya Income Tax Act 1967 With Complete Regulations And Rules 6th Edition 9789670853161

Pdf Complexity Of The Malaysian Income Tax Act 1967 Readability Assessment

How Much Does It Cost To Develop A Law Firm Mobile App Development

Income How Judges Determined Noor Rohin Binti Awalludin Ppt Video Online Download

Taxation Principles Dividend Interest Rental Royalty And Other So

Buy Income Tax Act 1967 Act 53 With Selected Regulations Rules As At 10th April 2022 Law Books Malaysia Joshua Legal Art Gallery

Income Tax Act 1967 Act 53 With Selected Regulations Rules Hobbies Toys Books Magazines Children S Books On Carousell

Librarika Income Tax Act 1967 Act 53

Rental Income Cash Basis Or Accrual Basis

As An Employer What Are Their Obligations In Terms Of Income Tax